- Annual prepay

- Monthly (with contract)

- Monthly (no contract)

The small business phone system with big benefits

Get a second phone line in minutes

Setup is easy — port over your existing business phone numbers, or pick new ones.

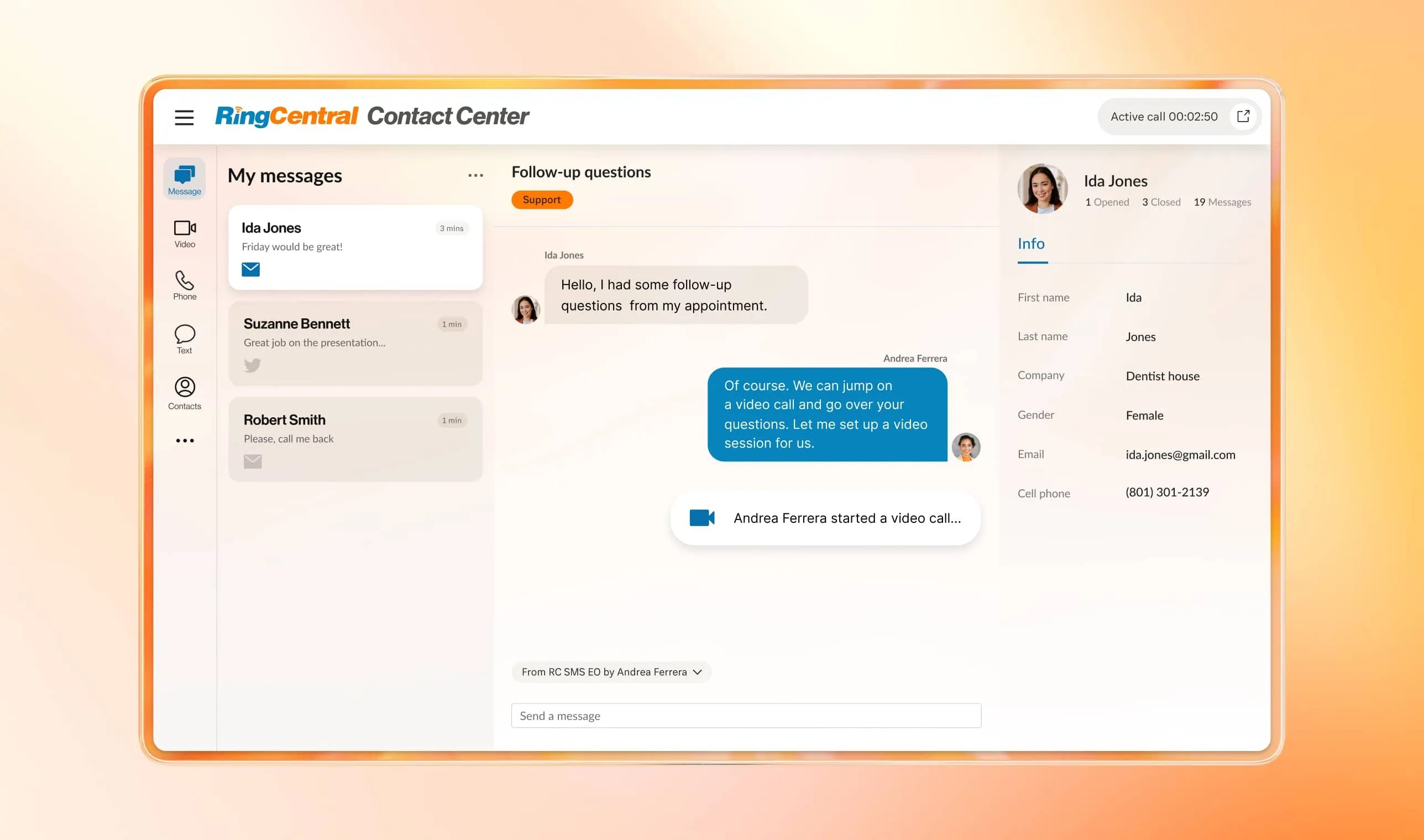

Stay connected in one reliable app

Talk, message, meet, and support customers—from anywhere, on any device.

Create a polished brand

Build custom greetings, set up dynamic call routing, and easily triage customer calls.

Never miss a customer interaction

Meet your customers where they are, across voice calls and 20+ digital channels.

Run your entire business on RingCentral

Pick the perfect plan

Payment and

pricing option

Save up to 33% by paying annually

Number of users

Now including an AI Assistant in every plan. Learn More

AI features that small businesses love

Built-in AI makes it easy for your team to grow and scale.

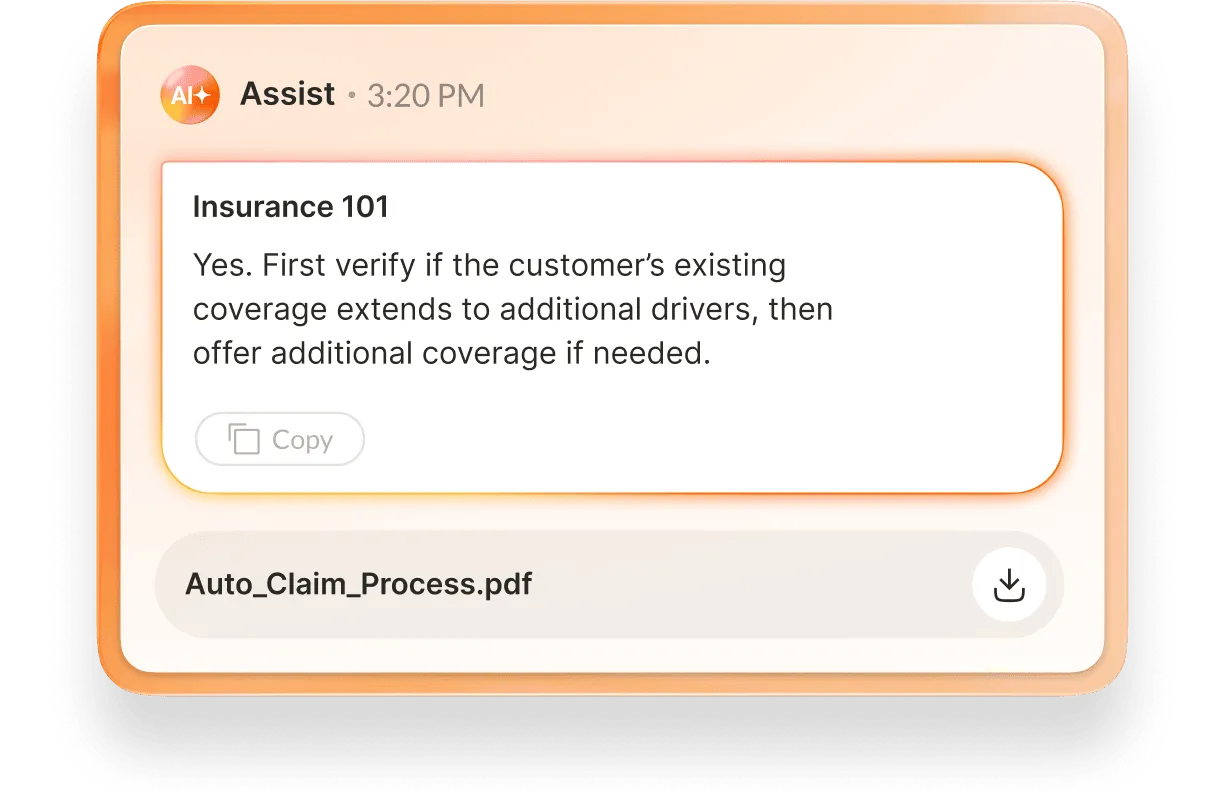

Automate customer support

Answer customer questions 24/7 with intelligent virtual agents that tap into your company’s knowledge base.

Solve customer requests even faster

Create effortless customer experiences with AI-generated answers during live customer calls.

Instantly draft messages

Craft clear, professional messages in a few clicks with AI.

Never take notes again

Automatically generate real-time call summaries and transcriptions.

Meet the new AI Assistant for your business phone that takes notes, writes, and translates

Designed for every industry

Real results for small businesses of all sizes

35%

Boost in productivity with deeper call reporting insights for IrisVision

$1k+

Estimated savings for Stumptown after switching to RingCentral

9.1

Average attendee NPS score by 356 Labs

40%

Average increase in agent productivity at Workato

Connect all your favorite tools

Integrate with our open platform, or build your own custom workflows using our APIs.

Trusted by the world's most innovative small businesses

An award-winning platform, trusted by customers around the world

Manage your small business on the go

Get the mobile flexibility your growing business needs. Work from anywhere while ensuring privacy, security, and compliance.

Questions? We’ve got you covered.

With an all-in-one communications system like RingCentral, all your communications channels are unified in a single platform. Outbound and inbound calls, video conferencing, team messaging, SMS…it all happens in one place, which means there’s no need to switch between multiple apps.

There’s file sharing and online fax, too — as well as hundreds of integrations with your favorite business tools.

A business phone system is the technology used by a company to maintain lines of communication with both internal and external contacts.

Traditionally, small businesses and large enterprises both used complicated systems of on-premises telephones to manage incoming and outgoing calls. Called private branch exchanges or PBXs, these business phone solutions were complex and expensive. Getting and running one entailed purchasing, setting up, and housing an array of equipment, such as desk phones, telephone cables, and even adapters.

For that reason, companies with lower budgets had to settle for lesser phone systems for small businesses, with fewer features.

These days, however, there has been a shift to digital business communications. New technologies are allowing businesses to enjoy a more remote-friendly, innovative, and cost-efficient way of handling phone calls: VoIP-based cloud phone systems.

These types of phone systems for businesses make it possible to make and receive calls using any device. Team members can use their laptops, desktops, or mobile devices for real-time communication. A strong internet connection and your VoIP service is all you need, and you are good to go!

Today’s telephone systems for small business are software-based. Companies don’t have to pay for, maintain, and upgrade on-site hardware. Instead, they sign up with a small business telephone system provider, download software or an app, and start calling.

Users get the same calling features of a traditional phone system—voicemail, call routing, call recording, call transfer, call forwarding, call waiting, auto-attendant, and more—while using Voice over Internet Protocol (VoIP) to facilitate calls over the Internet. This is far more cost-effective, flexible, and scalable. Plus, you only pay for what you use, not a cent more.

Additionally, hosted office phone systems for small businesses usually offer other capabilities for better business communications.

RingCentral RingEX, for example, is more than just a regular business phone system. We also integrate the features of team messaging, HD video calling, business SMS, faxing, IT and line of business analytics, embedded apps, and APIs to give you an all-in-one communications solution that works according to your business needs.

You can get local numbers, toll-free numbers, or international business phone numbers along with your business telephone solutions. This step is important in making sure your employees and clients can reach you anytime, anywhere.

With RingCentral, the process is very easy:

- Sign up for any RingCentral plan.

- Indicate what type of business phone number you need (toll-free or local), and you will be given a list of available numbers to choose from.

- You can also port your existing phone numbers, and we’ll take care of that for you. Read more here.

- Need to order more numbers? Once your account is ready, go to your dashboard. Go to Phone Numbers, then choose the Add Number option.

Exactly what you need from a business phone system will depend on your particular business. An ideal phone system for small businesses, for example, will likely need fewer functionalities than an enterprise phone solution. A sales-focused organization, meanwhile, may favor outbound dialing features over conference calling or file sharing.

Whatever your unique needs, however, here are some points to look for:

- Costs - One of the main reasons you are switching from traditional phones to business VoIP systems is for the savings. Be sure to find a plan that can help your company lessen equipment procurement, maintenance, and upgrade costs. A good virtual phone system, like RingCentral, can be up and running in minutes—meaning no downtime for your business! According to a 2022 survey, RingCentral customers saw a 23% decrease in average telecommunication costs, a 20% decrease in hardware costs, and a 16% decrease in overall IT spend when they migrated to RingCentral.

- Productivity - While the primary purpose of your IP telephony is to manage voice calls, it can also do so much more. With RingCentral, for example, you get unlimited calling, PBX functionality as well as the following unified communications features

- Audio conferencing

- Business SMS

- Device switching and call to video in 1 click

- Call logs and history

- Call screening and blocking

- Caller ID

- Multi-site management

- Hot desking

- Internet faxing

- Paging and intercom

- Video meetings

- Virtual receptionist

- Cost center management, role based access controls, single sign on and more!

- Reliability - This is a common concern among business owners, and it is completely understandable. That’s why it is crucial to set up secure business phone lines that are always reachable. At RingCentral, we have strong, financially backed 99.999% SLAs, and a 15+ quarter proven track record of reliability. With less than 6 mins of downtime every year, we deliver on our reliability promises and maintain the highest uptime among industry leaders.

- Security - With RingCentral, you can breathe easy knowing that multiple layers of redundancy, failover technology, physical and biometric security, encryption, system hardening, and 24/7 monitoring safeguard your data. Your valuable company data and communications are protected by enterprise-grade security.

- Continuity - Scalability is no longer a nice-to-have feature; it is a must. Make it a point to get a business phone system that grows as your business grows. With RingCentral, for instance, you can easily purchase, activate, and assign business phone numbers and virtual extensions to new users or departments. This can quickly be done on your computers or smartphones, too, so there’s no need for additional help or training to complete your expansion.

- Customer support - The best business phone systems are easy to implement and use. That doesn’t mean, however, that you’ll never need any help. Make sure your chosen provider is readily available to you by phone, email, and more. A comprehensive knowledge base for self-service solutions is a big plus, too.

- Cloud VoIP

- More than a business phone service, cloud VoIP is a reliable communications platform that eliminates the need for on-premise hardware. RingCentral provides reliable, high-quality phone service anywhere you have internet access.

- Virtual PBX

- Advance your communications with the industry leader in hosted PBX. RingCentral features a virtual PBX that has all the benefits of a traditional PBX system—auto-attendant, advanced call routing, virtual extensions, etc.—without the expensive landlines and limitations of hardware such as physical boxes, trunks, and switches.

- Calling and mobility

- Our calling features have been designed to give you a flexible, mobile, and powerful cloud phone system. Choose from a variety of available phone numbers including local and toll-free numbers, install our apps on your desktop computer, smartphone, or tablet, and improve communications with call forwarding, call flip, device switching, enhanced business SMS and more.

- Phone system administration

- Provision, manage, and gain insights anywhere with advanced administrative and analytics tools. Initiate instant employee moves, adds, and changes, even when you’re on the go. Simplify multi-site and number management and get a visual view of your IVR for easier editing.

- International phone system

- RingCentral offers extensive coverage with full service in over 45 countries and inbound virtual numbers in 105+ countries. Eliminate the cost and complexity of managing multiple disparate phone systems and benefit from simplified number management and international device shipping.

- Secure Communications

- From our product design to the operations of our business, we employ rigorous security and data best-practices in everything we do. We provide our customers with a robust security platform by integrating security principles into the development process from the get-go. See our Trust Center.

- Analytics & Reporting

- Gain in-depth insights in real time with our advanced call management system, IT and line of business analytics. Customize your own dashboards with 30+ pre-built KPIs and pull in-depth QoS reports for a complete view of system-wide quality and instant troubleshooting.

- Gain in-depth insights in real time with our advanced call management system, IT and line of business analytics. Customize your own dashboards with 30+ pre-built KPIs and pull in-depth QoS reports for a complete view of system-wide quality and instant troubleshooting.

Calling & mobility

Our calling features have been designed to give you a flexible, mobile, and powerful business phone system.

Our calling features have been designed to give you a flexible, mobile, and powerful business phone system.

Choose from a variety of available phone numbers including local and toll-free numbers. Install our apps on your desktop computer, smartphone, or tablet, or access your phone system via browser. Improve communications still further with call forwarding, call flip, device switching, call queues, ring groups, voicemail transcription, enhanced business SMS, and more.

Phone system administration

Provision, manage, and customize your small business phone solutions with advanced administrative tools. Initiate instant employee moves, adds, and changes, even when you’re on the go. Simplify multi-site and number management and get a visual view of your IVR for easier editing.

Provision, manage, and customize your small business phone solutions with advanced administrative tools. Initiate instant employee moves, adds, and changes, even when you’re on the go. Simplify multi-site and number management and get a visual view of your IVR for easier editing.

International phone system

Extensive coverage with full service in over 45 countries and inbound virtual numbers in 105+ countries. Eliminate the cost and complexity of managing multiple disparate phone systems and benefit from simplified number management and international device shipping.

Extensive coverage with full service in over 45 countries and inbound virtual numbers in 105+ countries. Eliminate the cost and complexity of managing multiple disparate phone systems and benefit from simplified number management and international device shipping.

Secure communications

From our product design to the operations of our business, we employ rigorous security and data best practices in everything we do. We provide our customers with a robust security platform by integrating security principles into the development process from the get-go. See our Trust Center.

From our product design to the operations of our business, we employ rigorous security and data best practices in everything we do. We provide our customers with a robust security platform by integrating security principles into the development process from the get-go. See our Trust Center.

Analytics & reporting

Gain in-depth insights in real-time with our advanced call management system, IT, and line of business analytics. Customize your own dashboards with 30+ pre-built KPIs and pull in-depth QoS reports for a complete view of system-wide quality and instant troubleshooting. Get almost instant oversight on call volumes (incoming calls and outbound calls) and other vital information.

Gain in-depth insights in real-time with our advanced call management system, IT, and line of business analytics. Customize your own dashboards with 30+ pre-built KPIs and pull in-depth QoS reports for a complete view of system-wide quality and instant troubleshooting. Get almost instant oversight on call volumes (incoming calls and outbound calls) and other vital information.

Yes, very! You might be a small business, but RingCentral is a business VoIP provider that gives you enterprise-grade security for your office phone system. This includes TLS authentication and SRTP encryption for phone calls, plus intrusion-detection systems and fraud analytics.

You also have a set of admin controls such as single sign-on (SSO) and multi-factor authentication (MFA). The platform is hosted across SSAE 18 and ISO 27001-audited data centers in geographically diverse locations.

Switch to the most reliable business phone system

And join over 400,000 customers who run their businesses on RingCentral.