Customer experience in financial services has arguably never been so important. In the midst of more complicated security and data privacy requirements and heightened competition, client and customer expectations have also risen. Today, consumers expect seamless and personalized CX from financial services institutions. If they don’t get it from you, they’re likely to find it elsewhere.

Financial services customer experience, then, is something you need to fully understand and know how to get right. That’s why we’re going to guide you through what financial services CX means and why it matters, and offer seven strategies to improve it across your organization.

What is customer experience in finance?

Customer experience in financial services is the sum total of all interactions a customer has with a financial institution—and the impression which those interactions leave.

That means that CX in financial services encompasses everything from when a customer initially engages with an organization to when they ultimately cut ties with them. And, potentially, beyond that, if your company tries to reengage and win back lost clients.

In a nutshell, financial services CX is the aggregate impression and opinion of your brand, developed across the entire customer journey.

Why does customer experience management for banking and financial services matter?

Customer experience management in financial services is everything you do to maintain the highest possible standard of CX across all touchpoints. It’s crucial, as it can be a key differentiator between you and the many rival firms in the industry, which are competing for the same clients.

Delivering outstanding customer experience has a direct impact upon customer retention and, on the flip-side, churn. If the experience you offer is seamless, consistent, and satisfying, your clients will stick with you and not move to your competitors.

What’s more, that can then have positive knock-on effects on customer acquisition. Satisfied customers, after all, are likely to become advocates and encourage friends or business contacts to use your services. Beyond that, too, delivering outstanding CX in financial services will also boost your brand reputation which is another great way to draw in new business.

How to improve customer experience in financial services: 7 Proven strategies

Customer experience in financial services, then, is undoubtedly important. If you want to ensure you’re not left behind by your competitors, check out these seven simple but impactful CX financial services strategies:

- Centralize your communication system

- Leverage predictive analytics and democratize your data

- Save everyone time with artificial intelligence

- Maintain a customer-centric culture

- Focus your efforts and find the right partners

- Reinforce employee training and retention strategies

- Balance data security with customer convenience

1. Centralize your communications system

A cloud-based, all-in-one communications system is foundational to an optimized financial services customer experience. It allows your representatives to seamlessly interact with customers across all popular communications channels. Each interaction with customers is recorded, and customers can connect with your agents however they want (phone, message, video, text, web chat, email, etc.).

Innovation in the delivery methods used for products and services is top of mind for competitive financial organizations today. A recent study by Qorus and Veripark found that there’s been a “shift towards ‘human-first, digitally enabled’ servicing models that balance digital innovation with the indispensable human touch.”

For example, advanced call routing allows you to put each customer in instant contact with the most qualified person to assist. This efficient system for enhancing service protects against the frustration that comes with call transfers and long wait times. That’s something which is especially relevant when you have contact center professionals who are licensed for specific products in specific states. Here’s how advanced routing works with RingCentral:

An all-in-one communications solution also powers efficient, effective collaboration for your team members. With the new reality of hybrid work in financial servicesk, agents can hold virtual meetings when employees are geographically dispersed. Team messaging allows for instant communication among team members. And file sharing helps every team member stay on the same page.

2. Leverage predictive analytics and democratize your data

It is difficult to optimize your financial services CX if you don’t know what customers want or expect. Communication tools that have baked-in predictive analytics allow you to gain the most accurate visibility into customer responses to service methods, features, and effectiveness. For instance, in RingCentral Live Reports, you can see how well your team is resolving customer issues, how many calls are being left on hold, and even which team members are the most efficient, all in real time:

Financial services organizations collect large volumes of data across all digital touchpoints every day. With the help of predictive analytics tools and generative AI in banking, institutions can gain deeper insights from both structured and unstructured data. This leads to a better understanding of customer preferences based on demographics, geography, lifestyle, and communication habits, making it easier to personalize the customer experience.

The second leg of the journey with analytics is to make the insights derived from them available to all the right stakeholders, including both employees and customers. Data democratization enables all employees to gain a deeper understanding of their customers, making it that much easier to provide excellence in customer experience.

Data democratization empowers customers by providing them with hyper-personalized offers and recommendations, enabling them to make better financial decisions based on their own real-time data.

Raja Rajamannar, CMO of Mastercard, notes: “Hyper-personalization is the future. Companies that understand the value of data and use it to create personalized experiences will thrive.”

3. Save everyone time with artificial intelligence

Artificial intelligence (AI) is a differentiator in financial services. It is a key determinant as to which organizations will grow and which ones will be left behind. Financial services organizations use AI in customer service in a number of innovative ways, including AI-powered chatbots, virtual agents, and virtual client onboarding, to name a few. Banks and insurance companies are also integrating it into their data and CX strategies.

AI-driven analytics further enhances the quality of data you collect and its usefulness when it comes to how to improve CX in financial services. In a centralized communications system, conversation intelligence is used to evaluate service interactions over time. AI is more capable than humans of identifying the impact of various techniques and messages on customer sentiment.

4. Maintain a customer-centric culture

Good CX starts with a customer-centric culture. Forbes describes customer centricity as “the ability of people in an organization to understand customers’ situations, perceptions, and expectations. The customer should be at the center of all decisions related to delivering products, services, and experiences to create customer satisfaction, loyalty and advocacy.”

Even with all the emphasis on digitization in CX analysis and the undoubted rise of digital customer experience in financial services, a customer-centric culture is still imperative. In a customer-centric culture, each employee recognizes how their role impacts the customer experience. All strategic decisions, capital investments, and training are designed to prioritize the customer experience.

When employees operate with a customer-first mindset, they are eager to find out how digital communication tools and other technology improve customer satisfaction. The value of a powerful digital infrastructure is magnified when your work teams have a natural desire to satisfy customers.

5. Focus your efforts and find the right partners

The old adage, “You can’t be all things to all people,” fits the current financial services climate. Stringent regulations and uncertain economic conditions put stress on organizations to deliver a great customer experience even while controlling costs. In response, some organizations have cut underperforming business units and products and concentrated efforts on their core customers.

Narrowing your strategy makes it simpler to develop successful, repeatable, customer-facing processes. Employees have a clearer sense of how their roles align with organizational objectives. Streamlined products and interactions give employees more opportunities to practice and review critical CX tasks.

At the same time they’re trimming the fat from their in-house offerings, forward-thinking financial institutions are partnering with fintechs and other service providers to enhance their desirability to an increasingly digital-native customer base.

Laura Spiekerman, co-founder and President of identity-decisioning platform Alloy, notes: “Partnerships with fintech companies help banks provide new features to eager customers without spending costly resources to build their own digital products, but while still earning a share of the profits.”

6.Reinforce training and motivation

Exceptional financial services CX requires consistent execution by your team members. Over time, it is easy for reps to fall into bad habits or forget how to optimize technology and resources. To maintain consistency and excellent service, you need to provide ongoing reinforcement training.

This type of training includes periodic coverage of the critical tasks, interactions, and tools reps use. The objective is to ensure that each employee understands the full capabilities of the resources available and leverages them within customer interactions. Training can include presentations on common tech tools, along with reviews of customer interaction recordings. A centralized communications system includes organized storage of customer calls.

RingCentral’s contact center solution includes powerful analytics and workforce management features that help supervisors understand individual agent and team performance to inform future training and coaching with a view to providing excellent customer experiences across the board.

7. Balance data safety and security with convenience

The government has increased regulations on safety and security of customer data. Firms must have more security measures in place to meet Know Your Customer (KYC) requirements, along with more routine customer verification processes.

These security measures are important for customers, but they also can lead to delays and frustration for customers trying to access accounts. The challenge for organizations is to incorporate necessary safety and security features with minimal disruption to CX in financial services.

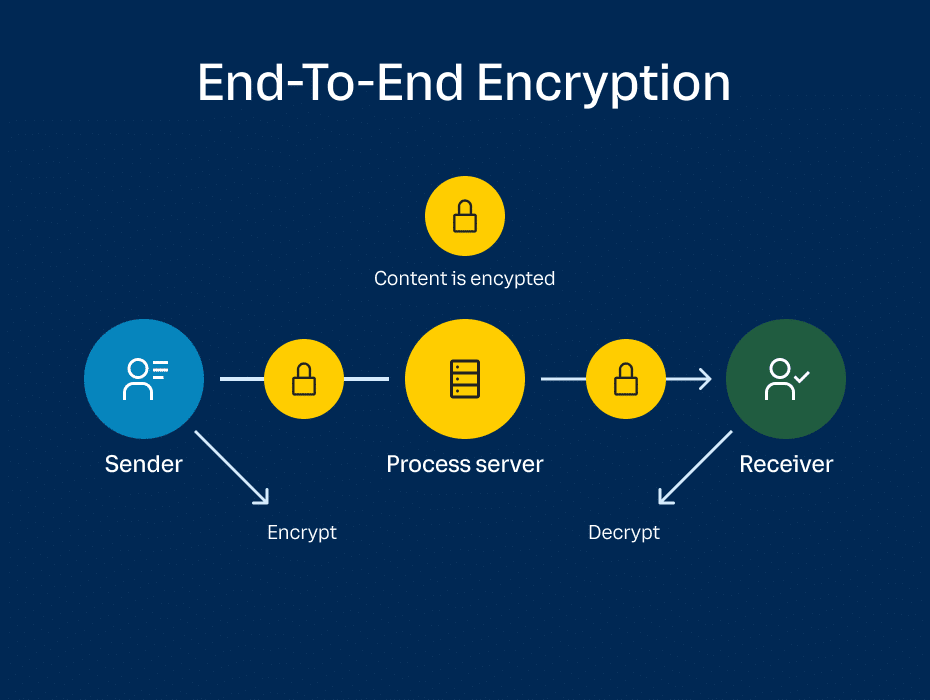

Built-in, advanced security protocols are another advantage of a robust, cloud-based communications solution. For example, multi-factor authentication and end-to-end-encryption are standard with RingCentral..

Improve CX in financial services with RingCentral

To do more with less while ensuring compliance, banks and other financial institutions invest heavily in technology, particularly solutions that increase automation. The objective is to balance excellent customer experiences with fiscal responsibility and best-in-class security.

RingCentral is a market leader in communications technology for the financial services industry. Our cloud-based, all-in-one solution for financial services includes:

- Omnichannel communications capabilities

- End-to-end encryption and best-in-class security

- AI-enabled communications such as chat bots, virtual agents, smart call routing, and more

- Powerful workforce management and optimization tools

- Predictive analytics that help financial institutions anticipate customer needs in advance

- Unified communications with voice, video, messaging, SMS text, webinar, and contact center

Now is the time to improve your financial services CX to remain competitive in an increasingly tight market. RingCentral can help you improve CX efficiently and effectively. See how it works today.

Customer experience financial services FAQs

What are some recent financial services customer experience trends?

Customer experience in financial services is a rapidly evolving area. Technological development, in particular, has given rise to some clear customer experience trends in finance. For instance, product delivery across more varied digital channels has undoubtedly been noticeable in recent years. What’s more, AI—and its ability to streamline operations and save time—is also increasingly playing a role in financial services CX.

Should we contract a customer experience agency for finance?

It is possible to hire external agencies to focus specifically on customer experience. As with most business decisions, whether to do so will depend on your unique circumstances. Whether you contract an agency or not, it’s still crucial to foster a customer-centric culture in your internal teams and to ensure they have the right tools to deliver seamless CX.

Why is an omnichannel contact center solution so useful for financial services CX?

An omnichannel contact center solution is designed specifically to help you provide reliable, consistent CX across channels. With a platform like RingCentral RingCX, your teams have all the information and functionality at their fingertips that they need to delight customers at all touchpoints.

Updated Apr 22, 2025