Whether you’re founding a new business or growing an existing one, it can be challenging to stay on top of all the elements you need to make it work, from marketing to designing your website.

One of those tasks is planning your business budget.

Creating a business budget is essential for every company, but it can be daunting if you’re in the first year and not familiar with the process.

So, to give you a helping hand, we’ve created a guide on improving your bookkeeping with a business budget template. Keep reading if you want to find out more about business budgets and how to customize the perfect template.

- What is a business budget exactly?

- What should a business budget template include?

- How do you create a business budget?

- How to make a budget template

💸 Want to get a head start on budgeting for your business? Download this free budget template!

What is a business budget?

A business budget includes all of your outgoings and expenses for a period of time, usually annually. Whether you’re a small business or a more mature corporation, you need a budget to plan for the months ahead.

This budget will help you:

- Forecast your expected sales and expenditures

- Track cash flow and monitor income sources

- Plan where is best to spend your revenue

- Stay organized and on top of your business finances

- See where improvements can be made from your plan vs the reality

- Fulfill financial goals

- Land funding to grow your business by including your strategy in your business plan

Most importantly, your budget will enable you to see the areas where you can save money. Many startup businesses have smaller expenses that can add up to a considerable sum by the end of the year. Software subscriptions is a big one—some tools are essential, but often, it’s possible to use an all-in-one platform that can take over for multiple apps.

For example, one of the most common scenarios in business is the use of video conferencing software. Many companies have one app for video meetings, another for team messaging, another for their business phone service, another for task management, and so on. But what if one app could do all those things?

The RingCentral app is an example of how you can save your business money in this exact way. It incorporates lots of features that you’d otherwise be paying multiple subscription services for. You can video call, make phone calls, and message your team and clients with this handy tool.

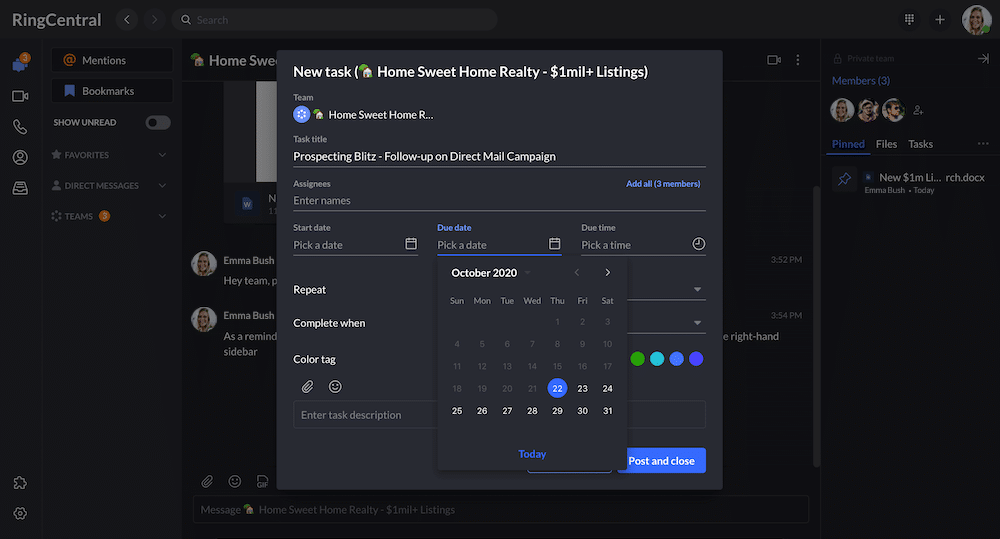

And that’s just the start, as its app integrations, file sharing, and task management features make it a super robust work platform:

Even though individually, these tools may seem cheaper, they can add up quickly—and often be more expensive than the one versatile software that got nixed early on because its price was slightly higher.

🕹️ Get a hands-on look at how RingCentral is designed to efficiently handle tasks that are usually done by multiple apps. Book a product tour:

💰 You can also use this calculator to see roughly how much your business could save by using RingCentral to support your team’s communication with each other—and clients.

What should your business budget template include?

When creating a business budget, you should include the following elements in order to gather an overall picture of where your finances stand.

1. Income projections

A key step in business budgeting is working out how much money will be coming in. To do this, you need to analyze your business.

For example, if you’re a sales-dependent company that generates a lot of its income from cold calling, tools like RingCentral can help your sales team analyze its performance more easily. You can create live reports to see how the sales team is getting on and gain data insights on how to improve customer experience. This is all part of a well-rounded outbound contact center that logs sales scripts for your team and keeps track of campaigns too:

You can use this information to predict your sales revenue. Then, add any other sources of income to your business each month. Tally all of your sources of income to determine an accurate income statement for the budget period. (It’s better to estimate too low, rather than too high, here.)

2. Determine fixed business expenses

Your fixed costs are essentially guaranteed expenses. This money comes out from your bank account without fail each month. This can include:

- Rent

- Payroll

- Business insurance

- Accounting software

- Certain predictable utilities, such as Wi-Fi

- Website hosting

You can review these businesses expenses through bank statements to see which costs are likely to stay the same month-to-month. You might even be able to get rid of some non-essential items.

3. Variable expenses

These are the operating costs that vary each month as a result of business activity. For example shipping costs, travel expenses, and freelancer rates. Over time, you should be able to gain a better understanding of when these expenses fluctuate so you can anticipate. For instance, if you’re a small business owner and you ship more products at Christmas time and other holidays, you can expect costs to climb at this time.

4. One-time costs

Sometimes, it can be difficult to predict one-time spending. Like when equipment breaks down and needs fixing, or if you want your employees to take part in an important training course.

However, they still need to be factored into your budget, because this will give you an idea of how much money to put by in the future for unexpected costs.

How do I create a budget spreadsheet for my business?

When creating a budget, many businesses like to have it planned within a budget spreadsheet. This is especially useful if you’re a startup and don’t have previous years to look back on.

A successful budget spreadsheet should give a clear overview of the business’s expenses and incomes.

To begin, ask yourself the following questions:

- What are your fixed costs?

- What are your variable costs and overheads?

- What are your projected sales for the budget period?

- What are the direct costs of sales? This includes production, materials, and contractors.

You can use a budget template or create your own budget spreadsheet with tools like Google Sheets or Microsoft Excel. If you’re not sure where to start, we’ll look at a few template ideas shortly.

How do I make a budget template?

Here are three free budget templates to use as inspiration for your budget plan.

1. Microsoft Office template

If you’re mainly concerned with planning your expenses, then you may find this Microsoft Office template useful. This worksheet provides charts and graphs of your monthly budget, for a clear and easy-to-digest look at your outgoings. There are tabs for both planned expenses and your actual expenses, which is ideal if you want to analyze how well you’re budgeting.

2. Capterra template

This Capterra template is popular because it offers an effective, clear overview of your budget. This budget worksheet is an Excel template, so it’s a great choice for anyone proficient in Microsoft Excel. You can create your monthly and annual budgets, including expenses, actual income, and one-time and variable costs.

Just in case you need some guidance, there is also a “Instructions” tab that goes into further detail about how to get the most out of the template.

3. Google Sheets templates

If you’re more familiar with Google Drive, then this may be the best option for you. From your Google sheets document, click on the template gallery option. This will bring up a variety of templates to choose from, like this annual business budget template. It includes a tab for income, expenses, and total amount summary based on the data from the other two tabs.

This is particularly helpful if you have a few people working on the budget, as they’ll all have access to the most up-to-date version of the file.

How do I set up a budget spreadsheet?

To start, pick a small business budget template of your choosing. Remember to check over the following:

- Double-checking the pre-filled formulas: If you add categories or move them around, ensure the calculations are still correct and the right cells contain the right formulas.

- Conditional formatting: This is used for data analysis and can be great for highlighting low or high values. Make a cell red if the budget amount or cost of goods are more than the budget. This will give you an overall picture of areas that need analyzing to find out why this happened.

- Income taxes: When you create your budget spreadsheet, be sure to include net income before taxes by deducting the total expenses from your total income.

- Large one-time expenses: Include your large one-time expenses, but in a separate column to other smaller, regular expenses. This will allow you to determine whether you can expand your spending in certain areas or if you’ve spent too much of your budget on larger purchases for this quarter/year.

It might be helpful to get some input from your business partners and managers. You can use RingCentral’s screen sharing feature to go through the budget with the team once you’ve got a rough draft. And, because it’s a video call, you can edit in real time and complete the budget remotely, without having to call an in-person meeting.

Get started on your business budgeting template

Now you’re equipped with all the tools you need to create an effective, accurate business budget template. This should help to track your cash flow and, ultimately, give you better control over your business. Startup costs can be tricky to predict, but by forecasting your budget, you’re giving your small business the best chance.

Don’t be afraid to take advantage of the free resources available online such as the Capterra template, but be sure to go over our checklist above to make the template work for you.

Updated Apr 02, 2025